Скачать с ютуб Canada Pension Plan (CPP) Explained: The Ultimate Guide To The Canada Pension Plan в хорошем качестве

Из-за периодической блокировки нашего сайта РКН сервисами, просим воспользоваться резервным адресом:

Загрузить через dTub.ru Загрузить через ClipSaver.ruСкачать бесплатно Canada Pension Plan (CPP) Explained: The Ultimate Guide To The Canada Pension Plan в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Canada Pension Plan (CPP) Explained: The Ultimate Guide To The Canada Pension Plan или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Canada Pension Plan (CPP) Explained: The Ultimate Guide To The Canada Pension Plan в формате MP3:

Роботам не доступно скачивание файлов. Если вы считаете что это ошибочное сообщение - попробуйте зайти на сайт через браузер google chrome или mozilla firefox. Если сообщение не исчезает - напишите о проблеме в обратную связь. Спасибо.

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Canada Pension Plan (CPP) Explained: The Ultimate Guide To The Canada Pension Plan

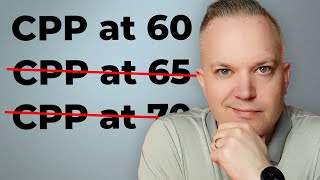

#CanadaPensionPlan #RetirementPlanning #CanadaFinance #CanadianRetirement 📈📚 Subscribe & Join our Financial Guide for Canadians - https://wealthawesome.com/ 📢 The Ultimate Guide to the Canada Pension Plan (CPP) Are you planning for retirement and want to understand how the Canada Pension Plan (CPP) works? This video is your one-stop guide to everything you need to know! We’ll break down the basics of CPP, when to start collecting your benefits, what affects your payouts, and strategies to maximize your retirement income. Whether you’re nearing retirement or just planning ahead, this video is packed with actionable tips to help you secure a stress-free future. ⏰ Timestamps: 0:00 - Introduction 0:48 - What is CPP? 1:37 - When Can You Start CPP? 1:41 - Starting CPP at 60 2:13 - Starting CPP at 65 2:36 - Starting CPP at 703:12 - What Affects Your CPP Amount? 3:16 - Contribution History 3:36 - Earnings Drop-Outs 3:55 - Disability and Survivor Benefits4:19 - How to Maximize Your CPP 4:25 - Delay Your Benefits 4:43 - Keep Working After 65 5:03 - Use Government Tools5:33 - Conclusion and Key Takeaways 📌 Key Takeaways: CPP is a government-run program offering retirement, disability, and survivor benefits. Starting CPP at 60, 65, or 70 comes with pros and cons. Factors like contribution history, earnings drop-outs, and disability benefits affect your payout. Strategies like delaying benefits or working after 65 can boost your CPP income. 💡 Don’t leave money on the table! Watch now to learn how to make the most of your CPP benefits. 📢 Don’t forget to:👍 Like this video🔗 Share it with a friend✅ Subscribe to our channel for more financial tips! #CanadaPensionPlan #CPP #RetirementPlanning #FinancialFreedom #CanadaFinance #CPPBenefits #RetirementIncome #CPPStrategy #RetireInCanada #CPPExplained #CanadianRetirement #FinancialTips 🏦🇨🇦 Subscribe to our channels: X - https://x.com/wealthawesome Linkedin - / wealth-awesome Disclaimer: The views and opinions shared on this channel are for informational and educational purposes only. Although previously licensed, the contributors are no longer industry participants and are not licensed to provide financial advice. They strive to provide you with educational information in an entertaining manner. Always do your own research and due diligence before investing. Generally speaking, you should consult a licensed investment professional before investing.