Скачать с ютуб Deciphering the Liquidity and Credit Crunch 2007-2008 (FRM Part 1 – Book 1 – Chapter 7) в хорошем качестве

Скачать бесплатно Deciphering the Liquidity and Credit Crunch 2007-2008 (FRM Part 1 – Book 1 – Chapter 7) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Deciphering the Liquidity and Credit Crunch 2007-2008 (FRM Part 1 – Book 1 – Chapter 7) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Deciphering the Liquidity and Credit Crunch 2007-2008 (FRM Part 1 – Book 1 – Chapter 7) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Deciphering the Liquidity and Credit Crunch 2007-2008 (FRM Part 1 – Book 1 – Chapter 7)

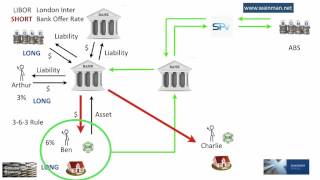

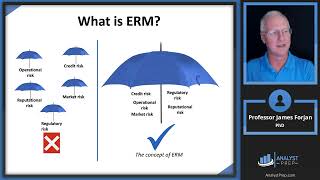

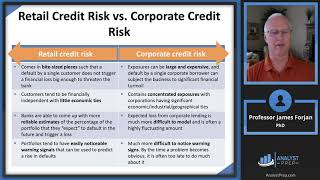

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite... AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams After completing this reading you should be able to: - Describe the key factors that contributed to the lending boom housing frenzy. - Explain the banking industry trends leading up to the financial crisis and assess the triggers for the liquidity crisis. - Describe how securitized and structured products were used by investor groups and describe the consequences of their increased use. - Describe the economic mechanisms through which the mortgage crisis amplified into a financial crisis. - Distinguish between funding liquidity and market liquidity and explain how the evaporation of liquidity can lead to a financial crisis. - Analyze how an increase in counterparty credit risk can generate additional funding needs and possible systemic risk. 0:00 Introduction 0:42 Learning Objectives After completing this reading you should be able to 1:41 What's a credit boom? 3:50 What happened in the lead up to the 2007/2008 financial crisis? 7:19 The Trends of Banking Industry Leading up to the Liquidity Squeeze 9:28 Securitization: Credit Protection, Pooling, and Tranching Risk 17:19 Funding Liquidity Risk versus Market Liquidity Risk 19:36 More Problems: Maturity Mismatch 21:29 Consequences: Cheap Credit and the Housing Boom 24:03 The Unfolding of the Crisis: Events Logbook 25:41 Asset-Backed Commercial Paper 26:40 More on Repo, Libor, and Federal Fund Markets 29:22 Continuing Write-Downs of Mortgage-related Securities 31:08 The Monoline Insurers 32:07 Notable Losers: Bear Stearns 33:54 Notable Losers: Government-Sponsored Enterprises 34:10 Central Banks Step Forward 34:52 Book 1 - Foundations of risk management Chapter 7

![PySpark Full Course [2024] | Learn PySpark | PySpark Tutorial | Edureka](https://i.ytimg.com/vi/sSkAuTqfBA8/mqdefault.jpg)