Скачать с ютуб Portfolio Return | Variance | Standard Deviation | Risk Calculation | Your Questions | My Answers в хорошем качестве

#FinanceSchoolWithMdEdrichMolla

standard deviation

expected return

expected return and standard deviation

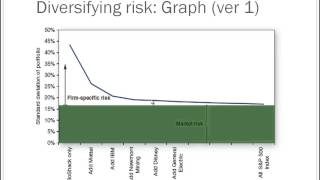

portfolio risk

risk and return

portfolio return

portfolio return formula

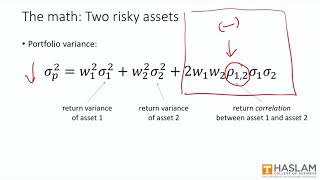

portfolio variance formula

portfolio standard deviation formula

beta calculation formula

systematic risk calculation formula

unsystematic risk calculation formula

residual variance calculation formula

portfolio total risk calculation formula

portfolio analysis

residual variance

Из-за периодической блокировки нашего сайта РКН сервисами, просим воспользоваться резервным адресом:

Загрузить через dTub.ru Загрузить через ClipSaver.ruСкачать бесплатно Portfolio Return | Variance | Standard Deviation | Risk Calculation | Your Questions | My Answers в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Portfolio Return | Variance | Standard Deviation | Risk Calculation | Your Questions | My Answers или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Portfolio Return | Variance | Standard Deviation | Risk Calculation | Your Questions | My Answers в формате MP3:

Роботам не доступно скачивание файлов. Если вы считаете что это ошибочное сообщение - попробуйте зайти на сайт через браузер google chrome или mozilla firefox. Если сообщение не исчезает - напишите о проблеме в обратную связь. Спасибо.

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Portfolio Return | Variance | Standard Deviation | Risk Calculation | Your Questions | My Answers

Portfolio Return - Variance Standard Deviation - Total Risk Calculation - Your Questions-My Answers You will be able to understand from this tutorial on portfolio return, portfolio variance, portfolio standard deviation, beta calculation, systematic risk calculation, unsystematic risk calculation, residual variance calculation, portfolio total risk calculation, portfolio return formula; portfolio variance formula, portfolio standard deviation formula, beta calculation formula, systematic risk calculation formula, unsystematic risk calculation formula, residual variance calculation formula, portfolio total risk calculation formula, portfolio analysis, portfolio return; portfolio return explained, portfolio return concept, portfolio return formula; portfolio return equation, portfolio return problem solution, portfolio return math solution; expected return, expected return and standard deviation, expected return of a portfolio, expected return and required rate of return on portfolio, expected return on portfolio from stock market, expected return probability, expected return and volatility, expected portfolio return of stock; expected portfolio return and variance, expected portfolio return from trading, expected portfolio return from swing trading, #portfolio_management #portfolio_variance #portfolio_standard_deviation #portfolio_total_risk ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ 🔰 You may learn other contents too: ▶️ Investment Setting | Chapter 1 | Investment Analysis & Portfolio Management | Reilly & Brown • Investment Setting || Chapter 1 || Investm... ▶️ The Asset Allocation Decision | Chapter 2 | Investment Analysis & Portfolio Management | Reilly & Brown • The Asset Allocation Decision | Chapter 2 ... ▶️ Organization & Functioning Of Securities Markets | Chapter 4 | Problem 1 | Investment Analysis and Portfolio Management | Reilly & Brown • Organization & Functioning Of Securities M... ▶️ Security-Market Indexes | Chapter 5 | Problem 1 | Investment Analysis and Portfolio Management | Reilly & Brown | 10th Edition • Price-weighted Index | Value-weighted Inde... ▶️ Efficient Capital Markets | Chapter 6 | Problem 1 | Investment Analysis and Portfolio Management | Reilly & Brown | 10th Edition @FinanceSchoolWithMdEdrichMolla • Abnormal Rates of Return | Efficient Capit... ▶️ An Introduction To Portfolio Management | Chapter 7 | Part I | Investment Analysis | Reilly & Brown • An Introduction To Portfolio Management | ... ▶️ Introduction to Asset Pricing Models | Chapter 8 | Investment Analysis & Portfolio Management | Reilly & Brown • Introduction to Asset Pricing Models | Cha... ▶️ An Introduction To Security Valuation | Chapter 11 | Problem 1 | Investment Analysis and Portfolio Management | Reilly & Brown • An Introduction To Security Valuation | Ch... ▶️ Bond Fundamentals | Chapter 17 | Problem 1 | Investment Analysis & Portfolio Management | Reilly & Brown • Bond Fundamentals | Chapter 17 | Problem 1... ▶️ Approximate Yield To call || Actual Yield to Call || Current Market Price of Bond || Chapter 18 || Problem 1 @FinanceSchoolWithMdEdrichMolla • Approximate Yield To call || Actual Yield ... ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ 🕵️♂️ You can search on this channel following topics: security analysis and portfolio management, investment analysis and portfolio management, investment analysis, portfolio management, portfolio, security market index, reilly and brown, reilly, brown, reilly brown, risk and return, capital budgeting, npv, irr, pv, fv, pbp, pi, financial formula, volatility, standard deviation, return, portfolio return, portfolio risks, beta, variance, covariance, portfolio risk, portfolio standard deviation, business statistics, chi square tests, mean, median, mode, gm, am, hm, geometric mean, arithmetic mean, harmonic mean, investment setting, asset allocation decision, organization and functioning of securities markets, efficient capital markets, an introduction to portfolio management, an introduction to asset pricing models, multifactor models of risk and return, analysis of financial statements, an introduction to security valuation, stock market, industry analysis, company analysis and stock valuation, equity portfolio management strategies, bond fundamentals, the analysis and valuation of bonds, bond portfolio management strategies, evaluation of portfolio performance, ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ 👉 Follow Us On- Facebook: / financeschoolwithmdedrichmolla Facebook Group: / 1340449306427547 Tiktok: https://www.tiktok.com/@md_edrich_mol... Instagram: / finance_school_with_emj Linkedin: / md-edrich-molla-248444a2 ResearchGate: / md-edrich-molla-248444a2 https://www.researchgate.net/profile/... Google Scholar: https://scholar.google.com/citations?... ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ 🤝Get in Touched- 📱 Whatsapp/messenger: +8801924030652 📨 [email protected] ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ Thank You and Best Wishes, Finance School With Md Edrich Molla 🎦 Copyright: Finance School With Md Edrich Molla ©️2023