Скачать с ютуб CFOA vs net income в хорошем качестве

cash flow

cash flow versus profit

cash from operating activities

cfoa

finance training

cash vs profit

cash flow statement indirect method

indirect method

difference between cash and profit

difference between cash flow and net income

cash flow versus profit and loss

cfoa vs net income

operating cash flow versus net income

Из-за периодической блокировки нашего сайта РКН сервисами, просим воспользоваться резервным адресом:

Загрузить через dTub.ru Загрузить через ClipSaver.ruСкачать бесплатно CFOA vs net income в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно CFOA vs net income или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон CFOA vs net income в формате MP3:

Роботам не доступно скачивание файлов. Если вы считаете что это ошибочное сообщение - попробуйте зайти на сайт через браузер google chrome или mozilla firefox. Если сообщение не исчезает - напишите о проблеме в обратную связь. Спасибо.

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

CFOA vs net income

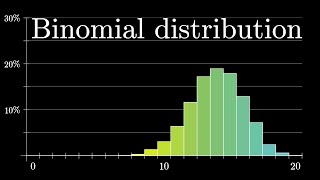

What are the main differences between CFOA (Cash From Operating Activities) and net income? For many companies, adding back depreciation and amortization, and adjusting for the changes in working capital items such as accounts receivable, inventory and accounts payable, are the main items in that calculation. Let’s assume we run a small factory. If we purchase raw material and pay the supplier for it, then this transaction does not impact profitability, but it does impact Cash From Operating Activities. If you use the machines in the factory to produce, you book a depreciation charge in the income statement. Your costs become higher, and your profit lower. For cash flow, depreciation is not relevant, as you do not pay depreciation to anyone, hence there is no cash outflow. If you sell goods to a customer on credit, you book the revenue and cost of goods sold of that sale when the goods are delivered and you meet all the revenue recognition criteria. The difference between the revenue and the cost of goods sold is your margin. For cash flow, this transaction does not do anything, as no cash is coming in to the company yet until the customer actually pays you. If you sell goods to a customer with a cash payment, both profit and CFOA are positively impacted. Now that you understand the difference between net income and CFOA conceptually, you are able to put together a cash flow statement using the indirect method: you start with the net income, and then make adjustments to reconcile that net income to CFOA. For many companies, adding back depreciation and amortization, and adjusting for the changes in working capital items such as accounts receivable, inventory and accounts payable, are the main items in that calculation. Speaking of cash flow, I have a lot of material available on the Finance Storyteller YouTube channel that can help you get a good understanding of the topic of cash flow and its related items. For example, I have full walk-throughs for you of the cash flow statements of Shell, Tesla and Walmart. I think the best way to learn how to read a cash flow statement is to go through as many real-life examples as you can! Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers training in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

![Build a 3-Statement Financial Model [Free Course]](https://i.ytimg.com/vi/Rmi9fwkJjHw/mqdefault.jpg)

![БУХГАЛТЕРСКИЕ ПРОВОДКИ с нуля: ПОЛНЫЙ КУРС за 5 часов [ТЕОРИЯ 📚 + ПРАКТИКА 💻]](https://i.ytimg.com/vi/wEZ1CqCWSXg/mqdefault.jpg)